THE COMPANY

- Pactor Finanças Corporativas is a financial company focused on providing financial advisory services in merger and acquisition (M&A) processes and strategic consulting to companies from several sectors of the Brazilian market.

- Its partners have extensive experience from several industries, accumulated over years of work for large banks, companies, and international consulting firms, and they directly lead all projects at Pactor.

- The most important guidelines of our work are:

- Absolute confidentially

- Alignment of interests between our clients and us

- Attention to specifics needs of each client and process

- Commitment, independence, and professionalism

- Comprehensive view of companies and processes

- Ethics

- Problem understanding followed by proposal of solutions

- Reasoning and analytical accuracy

- Teamwork and people development

- Transparency with our clients

GLOBALSCOPE

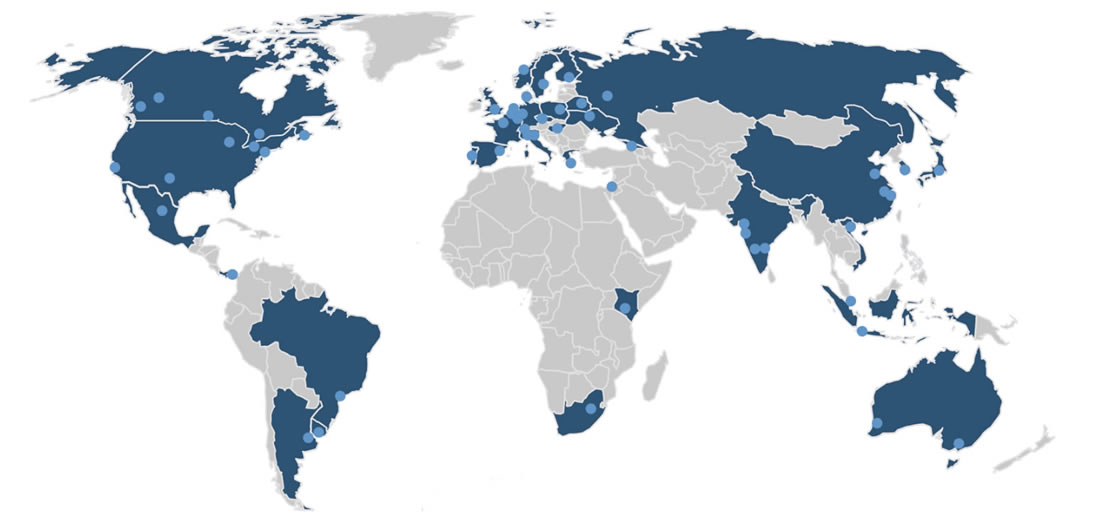

- Pactor is a member of Globalscope (www.globalscopepartners.com), one of the main international financial consulting groups specialized in mergers and acquisitions.

- CoWith its broad network, Globalscope is present in almost 40 countries and has over 500 professionals.

- Through Globalscope, Pactor has easy access to partners, investors and targets located in the most important markets throughout the world.

SERVICES

Negotiation AdviSORY (M&A)

The typical activities of M&A advisory services we provide may be grouped into three steps of the process: preparation, negotiation, and closing. Click on each of the steps for more details on the main typical activities covered:

- Company and market information search and analysis

- Economic valuation

- Identification and prospecting of potential strategic or financial investors (sell side)

- Identification and prospecting of target companies for acquisition (buy side)

- Initial approaches with potential investors or targets and negotiation and signing of confidentiality agreements (NDAs)

- Preparation and presentation of information memorandum and other documents about the target company and the investment opportunity

- Participation to be acquired

- Acquisition price

- Payment method

- Treatment to be given to potential contingencies

- Tax treatment of the deal

- Permanence or not of the main executives

Negotiation of the most important corporate principles in case of partial acquisition offers, either majority or minority, such as:

- Put and call options

- Tag along and drag along

- Dividend, indebtedness, and investment policies

- Voting rights, veto rights, and qualified matters

Signing of a Memorandum of Understanding (MOU)

Negotiation of representations and warranties based on the findings of the due diligence, together with our clients’ legal advisors.

Conduction and monitoring of the final negotiation of economic, corporate, and operational terms of the definitive documents until signing, which may include, among others:

- Shares/quotas purchase and sale agreement

- Shareholders/quotaholders agreement (in case of partial acquisitions, either majority or minority)

- Bylaws/articles of incorporation (in case of partial acquisitions, either majority or minority)

- Employment contracts of the managers

Economic Assessments and

Corporate Finance

- Valuation of companies

- Financial reestructuring

- Purchase price allocation (PPA) and valuation of intangible assets

- Impairment tests of goodwill and value of assets

- Financial feasibility analysis of projects

- Capital structure and cost of capital analyses

- Definition of dividend, indebtedness, and investment policies

- Organization and preparation of business plans

- Development of corporate strategies

- Definition of corporate governance

Examples of recent clients:

CUSTOMERS AND TRANSACTIONS

Click on each box below for more information:

Exclusive financial advisory to the partners of CredRisk Seguros in the sales of their shares to MDS Brasil

Exclusive financial advisory to Planus in the sale of its printing outsourcing operation to Selbetti

The partners of Agger, an IT company focused on the insurers and insurance brokers market, sold all the shares to Arco Capital

Exclusive financial advisory to Bidfood, food distributor specialized in the food service segment, in the acquisition of Vinhais Distribuidora de Alimentos

Exclusive financial advisory to the partners of Fix in the sale of their shares to Tempo Assist

Exclusive financial advisory to Bidfood, food distributor specialized in the food service segment, in the acquisition of specific operational assets from Leão Marinho

Exclusive financial advisory to the shareholder of Victory in the association with It’sSeg, a company invested by the private equity fund Actis

Exclusive financial advisory to System Interact partner, a credit recovery and collection solutions company, in the sale of a stake to Sercom

Exclusive financial advisory to partners of Planus, a company providing corporate technology solutions, in the sale of all of its stakes to Vinci Energies, of the Vinci Group

Exclusive financial advisory to a Founding Partner of System Interact, a credit recovery and collection solutions company, in the acquisition of all the company’s capital

Financial advisory services to Euroamerica, one of the most prominent insurance brokers in São Paulo, in expanding its strategic partnership with Marsh, the largest insurance broker in the world

Financial advisory to partners of Gebram, one of the leading insurance brokers in the interior of São Paulo, in the sale of a majority stake to It’sSeg, the largest independent insurance broker in Brazil

Exclusive financial advisory to R2Tech’s partners, a financial technology company, in the sale of a stake to PagSeguro, subsidiary of UOL

Exclusive financial advisory to Irmãos Avelino, a food distribution company focused on the food service segment controlled by Bidcorp (Bidvest Group), in the acquisition of a majority stake in Mariusso

Exclusive financial advisory to the shareholders of Rotovic, industrial laundry focused on uniforms and PPE, in the sale of the totality of their shares in Rotovic Camaçari to Elis

Exclusive financial advisory and business plan elaboration in the structuring of DataZap to Zap, the leading real estate web portal in Brazil, owned by Grupo Globo, the largest communication and media group of the country

Exclusive financial advisory to the shareholders of RealMedia Latin America, a leading provider of marketing and technology solutions to online advertisers and publishers, in the sale of the totality of their shares to AppNexus

Exclusive financial advisory to Zap, the leading real estate web portal in Brazil, owned by Grupo Globo, the largest communication and media group of the country, in the acquisition of the totality of Sub100

Financial advisory to Holomática in the total sale of its capital to Gi Group

Exclusive financial advisory to Kroton in the sale of an asset of in-class higher education in the Southeast region of Brazil to another institution of the educational sector

Exclusive financial advisory to Zap, the leading real estate web portal in Brazil, owned by Grupo Globo, the largest communication and media group of the country, in the acquisition of the totality of Pense Imóveis from Grupo RBS

Exclusive financial advisory to the shareholders of CNT Brasil, a benchmark company of information technology distribution in the value added distribution (VAD) segment, in the sale of the totality of their shares to Arrow

Financial advisory to Quirinvest in the sale of its operational assets to Radar (Grupo Cosan)

Exclusive financial advisory to the shareholders of Irmãos Avelino, a food distributor company focused on the food service segment, in the sale of a majority stake to Bidvest

Advisory to Van Leeuwen Pipe & Tube Group in the acquisition of 100% of the capital of Tubexpress

Exclusive financial advisory to Kroton in the sale of an asset of in-class higher education in the Southeast region of Brazil to another institution of the educational sector

Exclusive financial advisory to Lecca Financeira in the sale of its credit card operations to Senff

Exclusive financial advisory to the founding shareholders of Technos Seguros in the joint venture with Admiral Seguros

Exclusive financial advisory to the shareholders of Natique, industry of beverages, in the sale of a majority stake to Osborne

Exclusive financial advisory service to the founding shareholders of Gesto Saúde in the negotiation of the capitalization of the company with DGF fund

Exclusive financial advisory to the shareholders of iThink, digital marketing agency, in the sale of a majority stake to SapientNitro

Advisory to the shareholders of Papaiz Associados in the sale of their operations to companies directly controlled by Fleury S.A. e Odontoprev S.A.

Exclusive financial advisory and business plan elaboration to ABZZ, family office of the controlling shareholders of Arezzo & Co, in the acquisition of Memo, retail chain of sportswear

Advisory to Puritec Ambiental in raising capital from private investors through convertible debt attached to a call option

Advisory to Cremer in the negotiation of a preferential commercialization agreement for products manufactured by Embramed and in the negotiation of put and call options involving 100% of Embramed’s capital

Advisory to Cremer in the acquisition of operational assets from Topz

Exclusive financial advisory to The shareholders of Grupo pH, network of schools and preparatory courses, in the sale of the totality of their shares to Abril Educação

Advisory on investment in Quirinvest Empreendimentos e Agricultura by Aquila Capital, a German asset management firm

Exclusive financial advisory to the shareholders of Stan, real estate developer, in the sale of a minority stake to João Alves de Queiroz Filho, Brazilian businessman and controlling shareholder of Hypermarcas S.A.

Advisory to the parties in the acquisition of 100% of the capital of MA1 Corretora de Seguros Participações by APR Seguros

Exclusive financial advisory to Banco Paulista in the sale of the operation of vehicles financing and payroll loans to Banco Fibra

Exclusive financial advisory to the shareholders of BR3, agribiotechnology company, in the sale of a minority stake to Criatec Fund

Exclusive financial advisory to the shareholders of Kasinski, a Brazilian manufacturer of motorcycles, in the sale of the totality of their shares to

CR Zongshen

Advisory to Odontoprev in the acquisition of of the totality of Odontoserv and Adcon Administradora de Convênios Odontológicos

Advisory to Odontoprev in the acquisition of of the totality of Prontodente

Exclusive financial advisory to the shareholders of Grupo Volchi (Linces, Checkauto, and DNA Security) in the sale of a majority stake to Dekra

Exclusive financial advisory to the shareholders of Inpart Serviços, a leading provider of information services for the auto-insurance market, in the sale of the totality of their shares to Solera Holdings

Advisory to Cremer in the acquisition of the totality of the group composed by Hemocat and Biamed, distributers of Hospital Medical Products

Advisory to Odontoprev in the acquisition of of the totality of Sepao Assistência Odontológica

Project structuring, fund raising and operational management of Quirinvest,

a company that operates in the agribusiness sector, particularly in the cultivation and supply of sugarcane to mills

Advisory to Cejen Engineering in the acquisition of the totality of RioVivo, industrial sewage treatment plant of Brusque/SC

Exclusive financial advisory to the shareholders of Arezzo and Schutz in the merger of their companies into Arrezo & Co and sale of a relevant minority stake to Tarpon Investimentos

Exclusive financial advisory to the shareholders of Lecca Financeira in the sale of its operation of consumer credit to Banco Fibra

Exclusive financial advisory to the shareholders of Sunset, direct marketing agency, in the sale of a majority stake to Grupo ABC

Exclusive financial advisory to the shareholders of Providence, insurance broker, in the sale of the totality of their shares to Lazam MDS

Exclusive financial advisory to the shareholders of Central Energética Vale do Sapucaí – CEVASA in the sale of a stake to Cargill

Exclusive financial advisory to the shareholders of Áthos, insurance broker, in the sale of the totality of their shares to Willis Corretores de Seguros

Exclusive financial advisory to MetLife, a subsidiary of the largest life insurance company in the USA, in the acquisition of the totality of SOMA Seguradora

Exclusive financial advisory to the shareholders of Reali, insurance broker, in the sale of the totality of their shares to EuroAmérica

Advisory to Gralha Azul (Itau Group) in the sale of the totality of its operation Unimed Paraná

Advisory to the shareholders of Imarés Group on a merger with Sonda, the largest IT solutions integrator from Chile

Exclusive financial advisory to the shareholders of No Risk, insurance broker, in the sale of the totality of their shares to EuroAmérica

Advisory to the shareholders of IT Mídia, a company specialized on media for the IT industry, in the sale of a stake to Dynamo Venture Capital

Exclusive financial advisory to MetLife in the acquisition of the totality of the operations of Seasul Seguradora

Advisory to the shareholders of Care Plus in the sale of a stake to Bank of America

Advisory to the shareholders of Libra Clube in the sale of the totality of their shares to MetLife

Advisory to the shareholders of Perrotti in the sale of the totality of their shares to Structured Intelligence

Advisory to the shareholders of Maritima Seguros in the sale of its life insurance and private pension operations to Nationwide

Exclusive financial advice to the partners of Agger in the sale of their shares to Arco Capital

Pactor Finanças Corporativas is pleased to announce that it acted as exclusive financial advisor to the partners of Agger in the sale of the company to Arco Capital, marking the first acquisition of the Search Fund Arco Capital in Brazil.

Agger is a Brazilian IT company focused on developing technological solutions for the insurance market. Operating for over 26 years in Brazil, it has a broad portfolio of technological solutions (software) especially for managing insurance brokers.

Arco Capital is a Search Fund composed of a group of national and international investors with vast experience in various segments and industries that have acquired Agger as their growth platform in Brazil.

Exclusive financial advisory to the partners of CredRisk Seguros in the sales of their shares to MDS Brasil

MDS Group has acquired, through its local subsidiary MDS Brasil, the entirety of CredRisk Seguros, strengthening the group’s presence in the Brazilian insurance market.

CredRisk Seguros is a broker specialized in credit insurance in Brazil with over R$ 70 billion in insured credits. With more than 40 years of history, the company is a reference in pioneering and market knowledge, acting as a Trusted Advisor to its clients.

MDS Brasil is part of the MDS Group, an investee from the private equity fund Ardonagh, with operations in seven countries and approximately € 650 million in written premiums. MDS Brasil has 550 employees located in 12 offices and, with the acquisition of CredRisk, it has become the leading company in the country’s credit insurance market.

Exclusive financial advisory to Planus in the sale of its printing outsourcing operation to Selbetti

Planus sold its printing outsourcing operation to Selbetti as part of the its strategy to focus on its areas of expertise and value-added solutions, in line with its global portfolio.

Planus is a Brazilian information communication technology (ICT) company focused on the segments of corporate networks, managed services, cloud solutions, among others. With over 30 years of history, it is a reference of pioneering and innovation in Brazil, and it was acquired in 2020 by VINCI Energies, a French group with operations in more than 50 countries.

Selbetti is a Brazilian technology and innovation company based in the state of Santa Catarina, a pioneer in the printing segment in the country, with over 40 years of experience. The company operates in the areas of printing outsourcing, leasing of ICT assests, proprietary technology platforms and solutions, among others. With Planus, the company reinforces its operations in the outsourcing market, reaching the mark of 120 thousand devices managed throughout Brazil.

Bidfood acquired Vinhais Distribuidora de Alimentos, straightening its presence in the food service market in São Paulo.

Exclusive financial advisory to Bidfood, food distributor specialized in the food service segment, in the acquisition of Vinhais Distribuidora de Alimentos

Bidfood, a subsidiary of the Bidcorp Group, is one of the leading food service distribution companies in Brazil and worldwide, currently operating in more than 30 countries. Present in Brazil since 2014 through the acquisition of Irmãos Avelino, it has over 16,000 clients in the country and performs more than 400,000 deliveries per year.

Vinhais is one of the largest and most traditional distributors in the food service market for the state of São Paulo, with a broad portfolio of products, especially dairy products.

Bidfood acquired Vinhais Distribuidora de Alimentos, straightening its presence in the food service market in São Paulo.

Exclusive financial advisory to Bidfood, food distributor specialized in the food service segment, in the acquisition of Vinhais Distribuidora de Alimentos

Bidfood, a subsidiary of the Bidcorp Group, is one of the leading food service distribution companies in Brazil and worldwide, currently operating in more than 30 countries. Present in Brazil since 2014 through the acquisition of Irmãos Avelino, it has over 16,000 clients in the country and performs more than 400,000 deliveries per year.

Vinhais is one of the largest and most traditional distributors in the food service market for the state of São Paulo, with a broad portfolio of products, especially dairy products.

Tempo Assist acquired Fix, straightening its operations in the specialized domestic services market.

Exclusive financial advisory to the shareholders of Fix in the sale of their shares to Tempo Assist

Fix is a technology company specialized in the delivery of domestic services, which connects customers to professionals from different areas. Founded in 2017, it has accumulated tens of thousands of registered services on its platform, and its main markets are Greater São Paulo, Campinas, Porto Alegre and Curitiba.

Tempo Assist is the largest specialized assistance company in the Brazilian market. The company is an investee from the private equity funds Carlyle and Swiss Re, and runs a network of more than 22,000 service providers

Bidfood acquired specific operational assets from Leão Marinho, expanding its presence on the north coast of the state of São Paulo and the south coast of the state of Rio de Janeiro.

Exclusive financial advisory to Bidfood, food distributor specialized in the food service segment, in the acquisition of determined operating assets from Leão Marinho

Exclusive financial advisory to Bidfood, food distributor specialized in the food service segment, in the acquisition of determined operating assets from Leão Marinho

Bidfood, a subsidiary of the Bidcorp Group, is one of the leading food service distribution companies in Brazil and worldwide, currently operating in more than 30 countries. Present in Brazil since 2014 through the acquisition of Irmãos Avelino, it has over 16,000 clients in the country and performs more than 400,000 deliveries per year.

Leão Marinho is one of the largest and most traditional food distributors on the coastal areas of northern São Paulo and southern Rio de Janeiro, with expressive food service market share in the region, as well as retail clients.

Exclusive financial advisory to the shareholder of Victory in the association with It’sSeg, a company invested by the private equity fund Actis

Victory has associated itself with It’sSeg, strengthening the company’s presence in the Brazilian market for health plans and corporate benefits.

Victory is a consulting and insurance broker specialized in corporate benefits, such as health plans, dental plans, life insurance, and quality of life programs. Founded in 2000, it is a reference in the application of proprietary technologies in health management, with over 320 thousand lives managed and premia of R$ 300 million.

It’sSeg is currently the largest independent consulting,

benefit management firm, and insurance broker in Brazil. The company is invested by the private equity fund Actis and collects over R$ 2.3 billion in premia.

Exclusive financial advisory to System Interact partner, a credit recovery and collection solutions company, in the sale of a stake to Sercom

Exclusive financial advisory to System Interact partner, a credit recovery and collection solutions company, in the sale of a stake to Sercom

System Interact is a credit recovery and collection solutions company, mainly through its contact center and technology tools. With more than 20 years of history, it is a pioneer reference in the use of data analytics in its segment.

The Sercom Group is a company with multiple contact center solutions, including sales and relationship management. It currently has approximately 8 thousand employees and has a turnover of more than R$ 400 million.

Exclusive financial advisory to partners of Planus, a company providing corporate technology solutions, in the sale of all of its stakes to Vinci Energies, of the Vinci Group

Exclusive financial advisory to partners of Planus, a company providing corporate technology solutions, in the sale of all of its stakes to Vinci Energies, of the Vinci Group

Planus is an information and communication technology (ICT) company that operates in the segments of corporate networks, device and printer management, cloud solutions and support. With over 30 years of history, it is a benchmark for pioneering and innovation in Brazil.

Vinci Energies, a French company with operations in more than 50 countries and revenues of around € 14 billion, is the Vinci Group’s arm in ICT, energy and transport industry and infrastructure. In the ICT area, it operates worldwide with its Axians brand.

Founding partner

Exclusive financial advisory to a Founding Partner of System Interact, a credit recovery and collection solutions company, in the acquisition of all the company’s capital

A Founding Partner acquired the entire capital of System Interact.

System Interact is a credit recovery and collection solutions company, mainly through its contact center and technology tools. With more than 20 years of history, it is a pioneer reference in the use of data analytics in its segment.

Financial advisory services to Euroamerica, one of the most prominent insurance brokers in São Paulo, in expanding its strategic partnership with Marsh, the largest insurance broker in the world

Marsh has expanded its strategic partnership with Euroamerica.

Euroamerica is a reputable insurance broker recognized in the market for its technical capacity, segmented performance and qualified and experienced professionals. With more than 30 years of history, Euroamerica also operates in several other countries through strategic partnerships.

Marsh is a global leader in insurance brokerage, based in New York. The Marsh Group (MMC) is present in more than 130 countries, has a turnover of more than US$ 14 billion and about 65 thousand employees.

Financial advisory to partners of Gebram, one of the leading insurance brokers in the interior of São Paulo, in the sale of a majority stake to It’sSeg, the largest independent insurance broker in Brazil

![]()

It’sSeg acquired Gebram, strengthening its operations in Elementary Schools and accelerating its geographic expansion.

Gebram is one of the leading brokers in the Individuals segment in the interior of the state of São Paulo. Headquartered in Jundiaí and with more than 80 years of history, the company has more than 3,000 customers and 160 employees. The company has eight branches and 20 service points.

It’sSeg is currently the largest consultancy, benefits administrator and independent insurance broker in the country. The company is invested in the Private Equity Actis fund and generates over R$ 2 billion in premiums.

Exclusive financial advisory to IBBL partners, one of the leading companies in the manufacture and sale of water purifiers, in the sale of all their shares to Culligan

Culligan acquired all of IBBL, an invested company from Advent International, expanding its portfolio of residential, commercial and Point of Use (POU) water treatment products.

IBBL is a Brazilian company that for over 30 years has created and produced water purifiers for all Brazilian regions and exports to more than 40 countries. It is a pioneer in its sector and a leader in the manufacture and sale of POU equipment for filtering and purifying drinking water.

Culligan is an American water treatment company based in Rosemont, Illinois. Culligan specializes in softeners, water filtration and bottled water systems for residential, commercial and industrial consumers.

Exclusive financial advisory to R2Tech’s partners, a financial technology company, in the sale of a stake to PagSeguro, subsidiary of UOL

R2Tech is a financial technology company, operating both in Brazil and abroad, which develops and offers solutions for financial management, including receivables management, reconciliations, payments, billing and settlement, invoicing, gateways, among others.

PagSeguro is a payment processing company, which operates credit and debit cards, and also the largest online payment platform in Brazil. It is part of UOL, an internet company of content, products and services, controlled by Grupo Folha, one of the largest and most traditional media groups in Brazil.

Exclusive financial advisory to Irmãos Avelino, a food distribution company focused on the food service segment controlled by Bidcorp (Bidvest Group), in the acquisition of a majority stake in Mariusso

Irmãos Avelino is one the leading companies in food service distribution in Brazil. The company, founded in 1991, has more than 10,000 clients. In 2014, a majority stake in Irmãos Avelino was sold to Bidcorp (Bidvest Group), the third largest company in the world in the food service distribution segment and the one with broader global presence, in another transaction advised by Pactor.

Mariusso is a food service distribution company located in Paulínia (SP) and has more than 4,000 clients in the Metropolitan Area of Campinas and surroundings.

Exclusive financial advisory to the shareholders of Rotovic, industrial laundry focused on uniforms and PPE, in the sale of the totality of their shares in Rotovic Camaçari to Elis

Rotovic is a Brazilian company founded in 1968, focused on providing cleaning services, maintenance, and uniform and personal protective equipment (PPE) rental for the industrial segment.

Elis is a French industrial laundry group present in 12 countries. In 2013, it had acquired Atmosfera in Brazil. The group has more than 19,000 employees in nearly 300 operating centers, serving approximately 240,000 customers. Its revenues are approximately € 1.5 billion.

Exclusive financial advisory and business plan elaboration in the structuring of DataZap to Zap, the leading real estate web portal in Brazil, owned by Grupo Globo, the largest communication and media group of the country

Zap is the largest real estate web portal in Brazil and also the leading provider of advertising, information, and services to the national real estate market, such as the FipeZap index. The company is owned by Grupo Globo, the largest communication and media group of Brazil.

DataZap is Zap’s company focused on real estate intelligence. It aims at providing services that add value to the real estate agents, developing innovative products that support decision-making to build, invest, fund or trade in real estate.

Exclusive financial advisory to the shareholders of RealMedia Latin America, a leading provider of marketing and technology solutions to online advertisers and publishers, in the sale of the totality of their shares to AppNexus

Founded in 2002, RealMedia Latin America offers marketing and technology solutions to online advertisers and publishers. Among its customers are Globo, Estadão, Walmart, Mercado Libre, B2W, Yapo.cl, and El Universal Mexico.

AppNexus is the world’s leading independent ad tech company, which provides trading solutions and powers marketplaces for Internet advertising. Its platform empowers customers to more effectively buy and sell media.

Exclusive financial advisory to Zap, the leading real estate web portal in Brazil, owned by Grupo Globo, the largest communication and media group of the country, in the acquisition of the totality of Sub100

Zap is the largest real estate web portal in Brazil and also the leading provider of advertising, information, and services to the national real estate market, such as the FipeZap index. The company is owned by Grupo Globo, the largest communication and media group of Brazil.

Sub100 is one of the main real estate web portals of Southern Brazil, focused on Paraná state. The company also provides management systems to its clients, such as SGL (for new properties) and Subsee (for existing properties).

Financial advisory to Holomática in the total sale of its capital to

Gi Group

Holomática is a Brazilian specialized labor outsourcing company,, focused on the automotive industry.

GI Group is an Italian company of human resources solutions, such as recruitment and selection, management of temporary employment, outsourcing projects, training and business consulting in organizational development. In 2015, Grupo Gi provided services to approximately 12,000 companies, with total revenues of € 7 billion.

Exclusive financial advisory to Kroton in the sale of an asset of in-class higher education in the Southeast region of Brazil to another institution of the educational sector

Kroton Educacional is an educational company with wide presence in Brazil, both in in-class education, with 130 higher education units, and in distance learning, with over 700 distance learning poles. In 2014, Kroton concluded the merger process with Anhanguera, becoming the largest education company in the world. The company presents revenues of approximately R$ 3 billion.

Exclusive financial advisory to Zap, the leading real estate web portal in Brazil, owned by Grupo Globo, the largest communication and media group of the country, in the acquisition of the totality of Pense Imóveis from Grupo RBS

Zap is the largest real estate web portal in Brazil and also the leading provider of advertising, information, and services to the national real estate market, such as the FipeZap index. The company is owned by Grupo Globo, the largest communication and media group of Brazil.

Pense Imóveis is the main real estate web portal of Rio Grande do Sul and Santa Catarina states, founded by Grupo RBS, a traditional communication group with strong presence in Southern Brazil.

Exclusive financial advisory to the shareholders of CNT Brasil, a benchmark company of information technology distribution in the value added distribution (VAD) segment, in the sale of the totality of their shares to Arrow

CNT Brasil is a Brazilian company founded in 1994, reference in the value added distribution (VAD) segment of software and hardware in Brazil and in training, several times recognized with the most important awards in its segment. It is one of the leading distributors of virtualization and cloud computing solutions in the country.

Arrow Electronics is an American multinational public company, focused on the distribution of software, hardware, and electronics components. The company is present in over 58 countries and its revenues are approximately US$ 22 billion.

Financial advisory to Quirinvest in the sale of its operational assets to Radar (Grupo Cosan)

Quirinvest is a Brazilian company of the agricultural sector, focused on planting and supplying sugarcane for the sugar-alcohol industry.

Radar is a farm manager of the Grupo Cosan. Radar buys and adapts rural properties with agricultural potential. The company manages farms in eight Brazilian states, with more than 280 thousand hectares dedicated to the planting of sugar cane, soy, cotton and corn, among others.

Exclusive financial advisory to the shareholders of Irmãos Avelino, a food distributor company focused on the food service segment, in the sale of a majority stake to Bidvest

Irmãos Avelino is one the leading companies in food service distribution in Brazil, with operations concentrated in the state of São Paulo. The company, founded in 1991, has more than 10,000 clients and is the representative of the state of São Paulo in DIEFS (association of distributors specialized in food service).

Bidvest is a South African multinational public company, the third largest company in the world in the food service distribution segment and the one with broader global presence. The company has more than 100,000 employees and revenues of approximately US$ 15 billion.

Advisory to Van Leeuwen Pipe & Tube Group in the acquisition of 100% of the capital of Tubexpress

Van Leeuwen is a company based in the Netherlands and it is one of the largest global distributors of steel pipes, operating in the segments oil & gas, construction, and industry in general.

Tubexpress is a Brazilian company based in São Paulo, operating in the same branch of activity than Van Leeuwen.

Exclusive financial advisory to Kroton in the sale of an asset of in-class higher education in the Central-West region of Brazil to another institution of the educational sector

Kroton Educacional is an educational company with wide presence in Brazil, both in in-class education, with 130 higher education units, and in distance learning, with over 700 distance learning poles. In 2014, Kroton concluded the merger process with Anhanguera, becoming the largest education company in the world. The company presents revenues of approximately R$ 3 billion.

Exclusive financial advisory to Lecca Financeira in the sale of its credit card operations to Senff

Lecca is a traditional financial institution of Rio de Janeiro, founded in 1975.

Senff is a company based on Paraná with over 120 years of history and since 2000 dedicates itself exclusively to the card management.

Exclusive financial advisory to the founding shareholders of Technos Seguros in the joint venture with Admiral Seguros

Technos is a Rio de Janeiro insurance brokerage firm, whose original partners remained in operation after the transaction.

Admiral is a São Paulo insurance brokerage firm that started its activities 2000, focused on managing benefits for corporate clients. Later, the brokerage firm expanded its commercialization and consulting activities to other branches of insurance.

Exclusive financial advisory to the shareholders of Natique, industry of beverages, in the sale of a majority stake to Osborne

Natique is a Brazilian company of industrialization and distribution of beverages, especially spirits, among which Santo Grau cachaça, Liquid vodka, and Xiboquinha are the most noteworthy.

Osborne is one of the most traditional Spanish companies in the food and beverage sector, with almost three centuries of operation. The company has well-known brands of wines, spirits, and Iberian food, as well as operates restaurants. Osborne’s revenues are above € 230 million.

Exclusive financial advisory service to the founding shareholders of Gesto Saúde in the negotiation of the capitalization of the company with DGF fund

In February 2013, the Inova fund of DGF Investimentos made a capital injection in Gesto Saúde e Tecnologia.

Gesto is an early stage technology company, which offers health management services through a business intelligence platform in the SaaS (software as a service) model.

DGF Investimentos is a Brazilian private equity and venture capital fund founded in 2001 and one of the pioneers of this industry in Brazil.

Exclusive financial advisory to the shareholders of iThink, digital marketing agency, in the sale of a majority stake to SapientNitro

iThink is a Brazilian digital marketing agency founded in 2002 and led by Marcelo Tripoli, being the largest independent agency of the segment until the transaction.

SapientNitro is the largest digital agency of the United States and the third largest of the world. With more than 1,000 clients in several countries, SapientNitro serves the major global advertisers. Its revenues are approximately US$ 1.3 billion. In 2014, SapientNitro was acquired by Publicis, a French advertising group with revenues of approximately € 7 billion.

Advisory to the shareholders of Papaiz Associados in the sale of their operations to companies directly controlled by Fleury S.A. e Odontoprev S.A.

Papaiz Associados is a company with more than 30 years of existence, specialist in solutions of dental diagnostics by image, with emphasis on the examinations of computed tomography, panoramic radiography, documentation, among others.

Fleury is a reference group in the diagnostic medicine segment in Brazil, founded in 1926, with gross revenues above R$ 2 billion. OdontoPrev is a leader in the dental care segment in Brazil, with over 6 million beneficiaries. It is present in about 2 thousand municipalities and has more than 25 thousand accredited dentists.

Exclusive financial advisory and business plan elaboration to ABZZ, family office of the controlling shareholders of Arezzo & Co, in the acquisition of Memo, retail chain of sportswear

ABZZ is the family office of Birman family, majority and controlling shareholders of Arezzo & Co, the leading company in women’s footwear, handbags and accessories retail in Brazil.

Memo is a retail chain of sportswear (activewear and loungewear), founded by the shareholders of Affiniti Berlan knitwear. Memo is present in some of the major shopping malls in São Paulo.

Advisory to Puritec Ambiental in raising capital from private investors through convertible debt attached to a call option

Puritec is a technology company in the area of liquid effluent treatment, with recycled water generation, integrating physical-chemical, biological and final polishing technologies with filtration in membranes processes.

Advisory to Cremer in the negotiation of a preferential commercialization agreement for products manufactured by Embramed and in the negotiation of put and call options involving 100% of Embramed’s capital

Founded in 1935, Cremer is one of the largest and most traditional Brazilian companies of products in the areas of first aid, surgery, treatment, hygiene and wellness.

Embramed is a national company that has been operating in the hospital products market since 1989. Its brand is a market leader in several segments and it exports to over 15 countries in four continents.

Advisory to Cremer in the acquisition of operational assets from Topz

Founded in 1935, Cremer is one of the largest and most traditional Brazilian companies of products in the areas of first aid, surgery, treatment, hygiene and wellness.

Topz is a brand that belonged to EMS Group and with more than 30 years in the market. It has a complete portfolio of toiletries and cosmetics, with emphasis on cotton, cotton swabs, soaps, intimate soap, bandages, shampoos, antiseptic, brushes and dental tapes.

Exclusive financial advisory to The shareholders of Grupo pH, network of schools and preparatory courses, in the sale of the totality of their shares to Abril Educação

Grupo pH is composed by network of schools and educational courses located in the state of Rio de Janeiro, traditionally positioned as one of the best educational institutions in the region. The company was founded in 1987 and had approximately 7,000 students at the time of transaction.

Abril Educação is the educational company of Grupo Abril, one of the largest and most traditional Brazilian media groups. Abril Educação holds publishers, educational systems, preparatory courses, language schools, and complementary businesses, with revenues of approximately R$ 1 billion.

Advisory on investment in Quirinvest Empreendimentos e Agricultura by Aquila Capital, a German asset management firm

Quirinvest is a Brazilian company of the agricultural sector, focused on planting and supplying sugarcane for the sugar-alcohol industry.

Aquila Capital is a German asset management fund founded in 2001, with approximately € 7 billion in assets under management.

Exclusive financial advisory to the shareholders of Stan, real estate developer, in the sale of a minority stake to João Alves de Queiroz Filho, Brazilian businessman and controlling shareholder of Hypermarcas S.A.

Stan is a traditional real estate development company of São Paulo, founded in the 1940s. The company has developed more than 100 real estate projects in the city of São Paulo, standing out by the differentiated architecture of its projects, recognized by several awards received.

João Alves de Queiroz Filho is a well-known Brazilian entrepreneur, controlling shareholder of Hypermarcas, a consumer goods company with revenues above R$ 4 billion.

Advisory to the parties in the acquisition of 100% of the capital of MA1 Corretora de Seguros Participações by APR Seguros

MA1 is an insurance brokerage firm.

APR Seguros was founded in 2003 and it is considered one of the largest insurance brokerage firms in the Brazilian market, with more than R$ 350 million in managed premia.

Exclusive financial advisory to Banco

Paulista in the sale of the operation of vehicles financing and payroll loans to Banco Fibra

Banco Paulista is a commercial bank founded in 1990, with emphasis on the foreign exchange market, being among the 20 largest financial institutions in terms of volume traded and among the 10 largest in number of operations, according to the Brazilian Central Bank ranking.

Banco Fibra is a multiple bank owned by Vicunha Group, which also holds interests in Vicunha Têxtil, Companhia Siderúrgica Nacional (CSN) and Fibra Experts.

Exclusive financial advisory to the shareholders of BR3, agribiotechnology company, in the sale of a minority stake to Criatec Fund

BR3 Agrobiotecnologia is a company that develops biotechnology and chemical technology for agricultural use. The company is focused on research and development of innovative solutions for this market, such as Fegatex, a crop protection product.

Criatec is a seed capital fund, whose resources are mainly from BNDESPar and Banco do Nordeste do Brasil (BNB). Criatec has invested in 36 companies in Brazil in agribusiness, energy, media, healthcare, financial services, and information technology.

Exclusive financial advisory to the shareholders of Kasinski, a Brazilian manufacturer of motorcycles, in the sale of the totality of their shares to CR Zongshen

Kasinski is a Brazilian motorcycles manufacturer and retailer installed in the Free Economic Zone of Manaus, focused on 110cc to 650cc models. The company was founded in 1999 by Abraham Kasinski, a renowned industrialist in the Brazilian market, also founder of Cofap, an auto parts manufacturer.

CR Zongshen is a joint venture between Zongshen, one of the largest motorcycle and vehicles manufacturer of China, and CR Motors, owned by the Rosa family, which works in the Brazilian two-wheel (motorcycles and bicycles) market for over 30 years.

Advisory to Odontoprev in the acquisition of of the totality of Odontoserv and Adcon Administradora de Convênios Odontológicos

In March 2009, Odontoprev acquired Odontoserv, marking its entry into the Northeast region market and reinforcing its strategy of geographical expansion.

Odontoprev is the leading dental care company in Brazil, with over 70,000 corporate clients and more than 6 million beneficiaries. It is present in about 2 thousand municipalities in all regions of the country and has more than 25 thousand accredited dentists.

Founded in 1991, Odontoserv is a dental plan company operating in the states of Alagoas, Bahia, Paraíba and Sergipe.

Advisory to Odontoprev in the acquisition of of the totality of Prontodente

Odontoprev is the leading dental care company in Brazil, with over 70,000 corporate clients and more than 6 million beneficiaries. It is present in about 2 thousand municipalities in all regions of the country and has more than 25 thousand accredited dentists.

Prontodente is an operator of dental plans exclusively, created in 1974. At the time of the acquisition, it had about 40 thousand members.

Exclusive financial advisory to the shareholders of Grupo Volchi (Linces, Checkauto, and DNA Security) in the sale of a majority stake to Dekra

Grupo Volchi is the controlling shareholder of the companies Linces, Checkauto, and DNA Security. Linces is the leader in the segment of vehicle inspections in Brazil. Checkauto is a provider of historical vehicle data. DNA Security is a vehicle security company.

Dekra is a traditional German multinational company founded in 192, which operates in the automotive, industrial, and human resources segments, present in more than 50 countries. The company is a world leader in vehicle technical inspection and its revenues exceed € 2.3 billion.

Exclusive financial advisory to the shareholders of Inpart Serviços, a leading provider of information services for the auto-insurance market, in the sale of the totality of their shares to Solera Holdings

Inpart is a company that offers automotive information management service, supporting the largest insurance companies to find the best price to meet their needs.

Solera is present in more than 70 countries and provides digital solutions to manage risks and assets in vehicle and residence areas. Solera’s companies have more than 180,000 customers and process more than 200 million operations worldwide.

Advisory to Cremer in the acquisition of the totality of the group composed by Hemocat and Biamed, distributers of Hospital Medical Products

Founded in 1935, Cremer is one of the largest and most traditional Brazilian companies of products in the areas of first aid, surgery, treatment, hygiene and wellness.

Hemocat, a company based in Salvador, Bahia, is specialized in the commercialization of medical technologies, having commercial exclusivity of major international brands.

Advisory to Odontoprev in the acquisition of of the totality of Sepao Assistência Odontológica

Odontoprev is the leading dental care company in Brazil, with over 70,000 corporate clients and more than 6 million beneficiaries. It is present in about 2 thousand municipalities in all regions of the country and has more than 25 thousand accredited dentists.

Sepao Assist is a dental care company based in São Paulo.

Project structuring, fund raising and operational management of Quirinvest, company that operates in the agribusiness sector, particularly in the cultivation and supply of sugarcane to mills

The company operates in agribusiness, specialized in cultivation and supply of sugar cane and in the purchase and sale of agricultural real estate.

Advisory to Cejen Engineering in the acquisition of the totality of RioVivo, industrial sewage treatment plant of Brusque/SC

Cejen Engenharia has been operating in the Brazilian market since 1986, providing integrated and high quality works and systems in various segments of engineering and infrastructure.

Rio Vivo Engenharia was founded in 1995 and it is specialized in basic sanitation services, working in the areas of research, design, construction and services.

Exclusive financial advisory to the shareholders of Arezzo and Schutz in the merger of their companies into Arrezo & Co and sale of a relevant minority stake to Tarpon Investimentos

Arezzo & Co. is the leading company in women’s footwear, handbags, and accessories retail in Brazil. Founded in 1972, the company currently holds Arezzo, Schutz, Alexandre Birman, and Anacapri brands. Arezzo & Co is currently a public company with a market capitalization of approximately R$ 2 billion and revenues of approximately R$ 1 billion, with over 460 stores throughout Brazil and abroad.

Tarpon Investments is a private equity fund in operation since 2002 and publicly traded in Bovespa (São Paulo Stock Exchange). Tarpon’s funds have approximately R $ 10 billion in assets under management.

Exclusive financial advisory to the shareholders of Lecca Financeira in the sale of its operation of consumer credit to Banco Fibra

Lecca is a traditional financial institution of Rio de Janeiro, founded in 1975.

Banco Fibra is a multiple bank owned by Vicunha Group, which also holds interests in Vicunha Têxtil, Companhia Siderúrgica Nacional (CSN) and Fibra Experts.

Exclusive financial advisory to the shareholders of Sunset, direct marketing agency, in the sale of a majority stake to Grupo ABC

Sunset is a direct marketing agency led by Guto Cappio. The company operates in building relationships between its clients and brands and their customers.

Grupo ABC, founded and headed by Nizan Guanaes, is the largest advertising group in Brazil and one of the top 20 in the world. The group consists of 14 companies in the areas of advertising, marketing specialist services, content, and entertainment.

Exclusive financial advisory to the shareholders of Providence, insurance broker, in the sale of the totality of their shares to Lazam MDS

Providence is an insurance brokerage firm specialized in people insurance (life, pension, health and dental).

Lazam-MDS is a company founded in 1984 and controlled by the Portuguese group Sonae, operating in a wide range of insurance, reinsurance and risk areas.

Exclusive financial advisory to the shareholders of Central Energética Vale do Sapucaí – CEVASA in the sale of a stake to Cargill

Cevasa was founded in 1994, in the region of Patrocínio Paulista, SP. It is a mill specialized in grinding of sugar cane.

Cargill is a North American company operating in Brazil since 1965. It is one of the largest food companies in the world, with revenues of approximately US$ 60 billion.

Exclusive financial advisory to the shareholders of Áthos, insurance broker, in the sale of the totality of their shares to Willis Corretores de Seguros

Athos is an insurance brokerage firm specialized in people insurance (life, pension, health and dental).

Willis is an English insurance brokerage firm that has been operating in Brazil since 1958, with a growth strategy focused on acquisitions.

Exclusive financial advisory to MetLife, a subsidiary of the largest life insurance company in the USA, in the acquisition of the totality of SOMA Seguradora

MetLife is one of the largest life insurance providers in the world, founded in 1868. It has been present in Brazil since 1999 in the areas of life insurance, supplementary pension and dental plans.

Soma Seguradora is an independent Brazilian company focused on the life and pension segments.

Exclusive financial advisory to the shareholders of Reali, insurance broker, in the sale of the totality of their shares to EuroAmérica

Reali Vida Nova is a Brazilian insurance brokerage firm, which operates in multiple segments.

EuroAmerica was founded in 1985 and it is one of the largest insurance brokerage and risk consulting firms in the country. With 100% national capital, it also works in other countries through strategic partnerships.

Advisory to Gralha Azul (Itau Group) in the sale of the totality of its operation Unimed Paraná

Gralha Azul is a healthcare operator, which was acquired by Itaú Group in the purchase of Banestado of Paraná.

Unimed Paraná is a health system that began its activities in Ponta Grossa in 1979. Unimed system began in 1967 in Santos, São Paulo.

Advisory to the shareholders of Imarés Group on a merger with Sonda, the largest IT solutions integrator from Chile

Imarés Group is a Brazilian company of information technology (IT).

Sonda is a Chilean IT services provider, being the largest IT integrator in Chile and present in several Latin American countries.

Exclusive financial advisory to the shareholders of No Risk, insurance broker, in the sale of the totality of their shares to EuroAmérica

No Risk is a Brazilian insurance brokerage firm, which operates in multiple segments.

EuroAmerica was founded in 1985 and it is one of the largest insurance brokerage and risk consulting firms in the country. With 100% national capital, it also works in other countries through strategic partnerships.

Advisory to the shareholders of IT Mídia, a company specialized on media for the IT industry, in the sale of a stake to Dynamo Venture Capital

IT Media is a media company focused on the information technology sector.

Dynamo is a private equity fund founded in 1993 to manage variable income assets.

Exclusive financial advisory to MetLife in the acquisition of the totality of the operations of Seasul Seguradora

MetLife is one of the largest life insurance providers in the world, founded in 1868. It has been present in Brazil since 1999 in the areas of life insurance, supplementary pension and dental plans.

Seasul is an insurance company with a strong presence in the Japanese-Brazilian community.

Advisory to the shareholders of Care Plus in the sale of a stake to

Bank of America

Care Plus is one of the leading health care providers for the premium segment in Brazil.

Bank of America is a North American bank based in North Carolina and one of the largest financial institutions in the world, with more than US$ 800 billion of assets under management.

Advisory to the shareholders of Libra Clube in the sale of the totality of their shares to MetLife

Libra Clube is a traditional Brazilian insurance brokerage firm, founded in 1938.

MetLife is one of the largest life insurance providers in the world, founded in 1868. It has been present in Brazil since 1999 in the areas of life insurance, supplementary pension and dental plans.

Advisory to the shareholders of Perrotti in the sale of the totality of their shares to Structured Intelligence

Perrotti Informática is a Brazilian integrator of information technology solutions.

Structured Intelligence is an integrator of technology companies controlled by BankAmerica Capital, a private equity fund.

Advisory to the shareholders of Maritima Seguros in the sale of its life insurance and private pension operations to Nationwide

Marítima Seguros is a traditional Brazilian insurance company founded in 1943, operating in several segments.

Nationwide is a North-American financial services company with operations in the insurance segment.

TEAM

Dario Ferreira Guarita Filho (partner)

- Dario began his professional career in Brasmetal, having participated in the formation of joint ventures with Leonische Drahtwerk AG and CD Wälzholz, both from Germany. In the 1980’s, he began his career in the insurance industry in Universal Cia de Seguros Gerais as vice president and later as President of Finasa Seguradora, serving as a member of the Board of Directors, and he occupied a seat in the Council of Vera Cruz Seguradora and was a member of the National Council of Private Insurance and FENASEG

- Dario was a shareholder of Miller do Brasil associated with Miller Insurance London, a company acquired by WTW – Willis Tower Watson focused on the reinsurance brokerage area. He also founded Agrinvest, focused on origination of transactions in the agribusiness sector, and Guarita & Associados, focused on financial advisory

- Dario holds a bachelor’s degree in Economics from the Catholic University of São Paulo (PUC/SP)

Mauricio Schutt (partner)

- Financial Advisor with more than 20 years of experience in Corporate Finance, Mauricio worked at PricewaterhouseCoopers, Banco Bandeirantes de Investimentos, Banco Safra, and Chase Manhattan Bank, and was a founding partner at VGL Finanças Corporativas

- Besides processes of mergers and acquisitions, Mauricio has also conducted investment projects and other financial advisory projects (e.g. dividend policy, indebtedness policy and management of cost of capital to large publicly traded companies, such as Petrobras, Cemig, CPFL, and CCR)

- Mauricio holds a bachelor’s degree in Business Administration from Fundação Getulio Vargas (FGV-EAESP) and specialization course (CEAG) in Economics and Finance

Fernando Freitas (partner)

- Business consultant in the areas of strategy, organization and operations, and business development, being consultant and partner of McKinsey & Company and having accomplished projects for large national and multinational companies in Brazil and abroad

- Among those projects, the sectors of telecommunications, mining, oil and gas, steel, pulp and paper, agribusiness, and manufacturing may be highlighted, besides his experience as an executive at Telefonica in Brazil in the areas of business development and institutional relations

- Fernando holds a bachelor’s degree in Production Engineering from the Polytechnic School of the University of São Paulo (USP) and master degrees in Industrial Engineering (MSc) and Business Administration (MBA) from Michigan University

Alan Shwartzbaum (partner)

- Financial advisor with 15 years of experience in M&A and strategy consulting areas for several different industries and segments, with previous experience at VGL Finanças Corporativas, EuroPraxis Consulting, and Safra National Bank of New York in the United States

- Alan holds a bachelor’s degree in Business Administration from Fundação Getulio Vargas (FGV-EAESP), from which he received a merit scholarship and all the major academic awards of the institution, with one of the best academic performances of its history, and holds a double master degree in Management from The Global Alliance for Management Education (CEMS) at ESADE (Spain) and FGV-EAESP

Italo Marques

- Mergers and Acquisitions Analyst, with previous experience in Private Equity

- Italo holds a bachelor’s degree in Business Administration from the Federal University of Pernambuco (UFPE) and post-graduated in Financial Management from Insper

Rodrigo Rodrigues

- Mergers and Acquisitions Analyst, with previous experience in corporate strategy and new business development at Grupo Energisa. Rodrigo also worked as a consultant of infrastructure projects at Alvarez & Marsal and at Monitor Deloitte

- Rodrigo holds a bachelor’s degree in Mechanical Engineering from the Federal University of Rio de Janeiro (UFRJ)

Paulo Cassiano Bezerra

- Mergers and Aquisitions Analyst, with previous experience in financial services consulting, and member of the Insper Angels community

- Paulo holds a bachelor’s degree in Civil Engineering from Universidade Federal do Rio Grande do Norte (UFRN), with an international scholarship at the University of British Columbia (UBC), and a holds a Certificate in Financial Management, a graduate program from Insper

André Baptista

- Mergers and Acquisitions Analyst

- André holds a bachalor’s degree in Economics from Fundação Getulio Vargas (FGV – EESP), with focus on Financial Engineering

Felipe Hollnagel

- Mergers and Acquisitions Analyst, with previous experience in Structured Finance and FP&A

- Felipe holds a bachelor’s degree in Business Administration from Fundação Getulio Vargas (FGV-EAESP), with an international scholarship at the University of St. Gallen (HSG)

Danilo Cury

- Mergers and Acquisitions Analyst, with previous experience in Wealth Management

- Danilo holds a bachelor’s degree in Business Administration from Insper

Henrique Colaferro

-

Mergers and Acquisitions Analyst, with previous experience in Private Equity and Corporate Investment Banking

-

Henrique holds a bachelor’s degree in Business Administration and Economics from Northeastern University

CONTACT

263, 18th floor, Funchal Street

Vila Olímpia, São Paulo, SP

CEP 04551-060

+ 55 11 3071 0000

E-mail: pactorfc@pactorfc.com.br

If you are interested in joining our team, send your resume to recrutamento@pactorfc.com.br